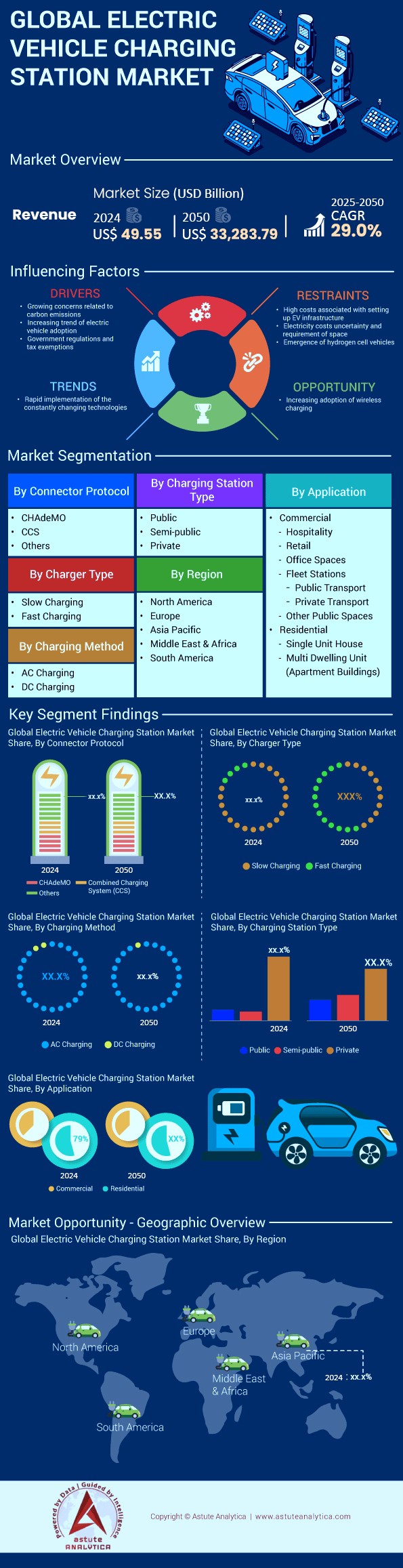

Electric Vehicle Charging Station Market – (By Connector Protocol – CHAdeMO, CCS, and Others; By Charger Type – Slow Charging and Fast Charging; By Charging Method – AC Charging and DC Charging; By Charging Station Type – Public, Semi-Public, and Private; By Application – Commercial and Residential); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2050

- Last Updated: Mar-2025 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0421078 | Delivery: 2 to 4 Hours

| Report ID: AA0421078 | Delivery: 2 to 4 Hours

Market Scenario

Electric vehicle charging station market is projected to increase from US$ 49.55 billion in 2024 to US$ 33,283.79 billion by the end of 2050 at a robust CAGR of 29.0% during the forecast period 2025–2050.

The electric vehicle charging station market has witnessed remarkable technological advancements by 2025, with ultra-fast charging, wireless charging, and smart charging solutions at the forefront of innovation. Ultra-fast charging capabilities have significantly improved, with chargers now delivering power at 350 kW or higher, enabling EVs to charge to 80% capacity in under 10 minutes. This breakthrough has addressed range anxiety concerns for long-distance travelers and fleet operators. Wireless charging technology has made substantial progress, with dynamic wireless charging systems being tested in cities like Seoul and Oslo, allowing EVs to charge while in motion at low speeds. These systems use electromagnetic inductive charging and in-road wireless charging technologies, embedding charging devices in roadways to power vehicles as they drive. Smart charging solutions have become more sophisticated, integrating with smart grids to optimize energy use and reduce costs. The adoption of the Open Charge Point Protocol (OCPP) 2.0.1 has enhanced communication between charging stations and central management systems, supporting features like smart charging, security enhancements, and plug-and-charge capabilities.

Government initiatives worldwide have played a crucial role in expanding electric vehicle charging station market. In the United States, the Infrastructure Investment and Jobs Act (IIJA) has allocated $7.5 billion for EV charging infrastructure, with a goal of installing 500,000 public chargers by 2030. The National Electric Vehicle Infrastructure (NEVI) program has driven the addition of over 100,000 fast chargers in 2024 alone. The European Union's Alternative Fuels Infrastructure Regulation (AFIR) has set ambitious targets for charging coverage, resulting in over 500,000 fast chargers across Europe. China continues to lead globally, with 2.1 million fast chargers and 5 million slow chargers installed by 2025, driven by aggressive infrastructure deployment strategies. Emerging markets like India and Brazil are also making strides, with India's FAME II scheme and Brazil's national EV plan driving infrastructure development. These government-backed initiatives have not only stimulated the EV charging market but also created a positive feedback loop, encouraging more consumers to adopt EVs and further driving demand for charging solutions.

The distribution of electric vehicle charging station market has evolved significantly, with both fast and slow chargers seeing widespread deployment. China dominates with 2.1 million fast chargers, followed by Europe with 500,000 and the U.S. with 250,000. Slow chargers remain essential for residential and workplace charging, with China leading at 5 million installations. Regional availability patterns show high charger density in urban areas of Europe and the U.S., while rural areas are catching up. Major manufacturers like Tesla, ChargePoint, and ABB are driving innovation, with Tesla's Supercharger network expanding globally and ChargePoint integrating advanced software for real-time monitoring. Strategic partnerships, such as the IONNA consortium involving automakers like GM and BMW, aim to build 30,000 high-power chargers across North America. Investment in the sector remains robust, with over $1 billion in private equity deals in 2024 alone. Consumer behavior is shifting, with a significant portion of charging sessions occurring at home, and fast charging preferred for on-the-go convenience. The industry is addressing supply chain challenges through modular solutions and renewable energy integration, highlighting the dynamic growth and innovation in the EV charging market as of 2025.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Government incentives and subsidies for EV adoption and infrastructure development

Government-backed incentives and subsidies have become a cornerstone in accelerating the adoption of electric vehicles (EVs) and the growth of the electric vehicle charging station market. Across Europe, financial incentives have significantly boosted EV adoption rates. For example, studies reveal that purchase incentives, averaging around $1,897 per vehicle, have played a pivotal role in increasing Battery Electric Vehicle (BEV) registrations over time. These incentives, including tax rebates, ownership benefits, and purchase subsidies, have effectively reduced the upfront cost barrier for consumers. Norway, a global leader in EV adoption, saw electric vehicles account for 79.3% of new car sales in 2022, with projections suggesting this could climb to 90% by 2025, thanks to robust government support.

In the United States, the Infrastructure Investment and Jobs Act (IIJA) has earmarked $7.5 billion specifically for the development of EV charging infrastructure. This funding is part of a broader effort to install 500,000 public chargers nationwide by 2030. The impact is already evident, with the U.S. adding over 100,000 fast chargers in 2024 alone, bringing the total to more than 250,000 public fast chargers by 2025. Similarly, China’s aggressive infrastructure push has resulted in the installation of approximately 5 million slow chargers and 2.1 million fast chargers by 2025. These government initiatives not only stimulate the electric vehicle charging station market but also create a positive feedback loop, where improved infrastructure availability encourages more consumers to adopt EVs, further driving demand for charging solutions.

Trend: Vehicle-to-Grid technology enabling bidirectional energy flow between EVs and grid

Vehicle-to-Grid (V2G) technology is emerging as a transformative trend in the electric vehicle charging station market, enabling bidirectional energy flow between EVs and the power grid. This technology turns EVs into active participants in grid management, requiring advanced bidirectional chargers and sophisticated battery management systems that support two-way electricity flow. These systems provide critical grid services such as frequency regulation and voltage control, which are essential for maintaining grid stability. To ensure security, V2G systems are increasingly incorporating blockchain protocols and real-time monitoring to mitigate potential cyber threats.

Real-world applications of V2G technology are demonstrating significant benefits in grid stability and energy efficiency. For example, a pilot program in California involving V2G-enabled electric school buses has shown remarkable success. These buses return energy to the grid during peak demand periods, resulting in substantial energy savings and reduced grid strain. In Europe electric vehicle charging station market, V2G trials have highlighted the technology’s ability to integrate renewable energy sources more effectively. By storing excess energy during periods of high renewable generation and supplying it back to the grid during low output periods, V2G systems help balance the grid and support higher renewable energy penetration. This capability is particularly valuable in addressing the intermittency challenges of solar and wind power. Additionally, V2G technology offers financial incentives for EV owners, who can earn revenue by participating in V2G programs and selling stored energy during peak pricing periods. As the technology matures, V2G is poised to play a critical role in the future of sustainable energy systems, offering both technical and economic benefits to grid operators and EV owners alike.

Challenge: Limited availability of space in urban areas for charging stations

The electric vehicle charging station market faces a significant hurdle in the limited availability of space in urban areas for installing charging infrastructure. As cities grow denser and land values soar, finding suitable locations for charging stations without disrupting urban landscapes or compromising pedestrian spaces becomes increasingly challenging. This issue is particularly acute in high-density urban areas where parking spaces are already scarce. For instance, Amsterdam has adopted innovative solutions by integrating charging stations with existing street furniture, optimizing space utilization while preserving the city’s aesthetic and accessibility.

To address this challenge in the electric vehicle charging station market, cities are exploring multi-functional and modular charging solutions that maximize the utility of limited urban spaces. Modular charging stations, which can be integrated into existing parking structures or street lighting systems, offer flexibility and scalability based on demand. Another innovative approach is the development of pop-up charging stations that can be retracted into the ground when not in use, freeing up sidewalk space during off-peak hours. In London, a trial of pop-up chargers in residential areas has shown promising results in meeting the needs of EV owners without permanent alterations to streetscapes. Additionally, cities are leveraging spatial data science and multi-agent reinforcement learning (MARL) algorithms to identify optimal charging station locations. A 2022 study highlighted the importance of using these technologies to enhance the accessibility and convenience of EV charging stations while minimizing their footprint. By analyzing Points of Interest (POI) data and visualizing potential layouts, urban planners can identify underutilized spaces for EV charging, optimizing space utilization in congested urban environments. These solutions are critical for the continued growth of the electric vehicle charging station market in urban areas.

Segmental Analysis

By Charger Types: Slow Charging (<=22kW) control over 81.80% market share

Slow charging technology, operating at power levels up to 22kW, has become the backbone of the electric vehicle (EV) charging infrastructure, particularly in residential and workplace settings. This dominance is attributed to its compatibility with existing electrical systems and the convenience it offers for overnight charging. As of 2025, the number of slow chargers installed globally has surpassed 15 million units, with China leading the way with over 5 million installations. In Europe, countries like Norway and the Netherlands have achieved a ratio of one slow charger per 10 EVs, significantly reducing range anxiety and promoting EV adoption.

The widespread adoption of slow charging in the electric vehicle charging station market has spurred innovations in smart charging technologies. For instance, the implementation of ISO 15118 standard has enabled plug-and-charge capabilities, allowing for seamless authentication and billing without the need for cards or mobile apps. This has improved user experience and increased the utilization rates of public slow chargers. Additionally, Vehicle-to-Grid (V2G) technology has been integrated into many slow charging systems, allowing EVs to act as mobile energy storage units. In a pilot project in the UK, a fleet of 1,000 EVs equipped with V2G-enabled slow chargers successfully provided 5 MW of flexible capacity to the grid during peak hours, demonstrating the potential of slow chargers in grid stabilization and renewable energy integration.

By Charging Methods: DC Charging control over 95.30% market share

Direct Current (DC) charging in the electric vehicle charging station market has emerged as the preferred method for rapid charging, particularly for long-distance travel and commercial fleet operations. The proliferation of DC charging stations has been driven by advancements in charging speeds, with ultra-fast chargers now capable of delivering up to 350 kW of power. This has significantly reduced charging times, with some EV models able to add 200 miles of range in just 15 minutes. As of 2025, the global network of DC fast chargers has expanded to over 3 million units, with major charging networks like Tesla Supercharger, Ionity, and Electrify America leading the deployment in their respective regions.

The technological evolution of DC charging has also focused on improving efficiency and reducing environmental impact. Liquid-cooled charging cables have become standard in high-power DC chargers, allowing for thinner, more flexible cables that can handle higher currents without overheating. This has improved user experience and reduced maintenance costs. Moreover, the integration of energy storage systems with DC charging stations has gained traction. For example, a network of 500 DC charging stations in California has been equipped with on-site battery storage, totaling 250 MWh of capacity. This setup not only reduces strain on the grid during peak charging times but also enables the integration of renewable energy sources. The stored energy can be used to power the charging stations during periods of high demand or low renewable energy generation, enhancing the overall sustainability of the charging infrastructure.

By Applications: Residential application of the charging station take up more than 56% market share of the electric vehicle charging station market

Residential applications have become the primary focus of the electric vehicle charging station market, driven by the convenience and cost-effectiveness of home charging. As of 2025, the number of residential charging points has exceeded 30 million globally, with countries like Norway and the Netherlands achieving a ratio of one residential charger per EV. This high penetration has been facilitated by government incentives and building regulations mandating EV charging readiness in new constructions. For instance, California's building codes now require all new single-family homes and multi-unit dwellings to be EV-ready, leading to the installation of over 2 million residential charging points in the state alone.

The technological landscape of residential charging has evolved to address the unique challenges of home charging. Smart load management systems have become standard, allowing multiple EVs to charge simultaneously without overloading the home's electrical system. A notable innovation in the electric vehicle charging station market is the development of dynamic power sharing algorithms, which can allocate available power among multiple charging points based on real-time demand and user preferences. This has enabled the efficient use of existing electrical infrastructure without requiring costly upgrades. Additionally, the integration of residential chargers with home energy management systems has gained traction. For example, a pilot project involving 10,000 homes in Germany demonstrated that smart residential chargers, when integrated with rooftop solar and home batteries, could reduce grid dependency by up to 70% during peak hours. This not only lowered electricity costs for homeowners but also contributed to grid stability by reducing peak demand.

By Charging Station Types: Private charging station capture over 88.20% market share

Private charging stations have become the cornerstone of electric vehicle charging station market, driven by the convenience they offer to EV owners and the reduced strain they place on public charging networks. As of 2025, the number of private charging points globally has surpassed 50 million, with residential installations accounting for the majority. In countries like Germany and the UK, government incentives have led to over 80% of EV owners having access to a private charger. This high penetration of private charging has significantly reduced the demand on public charging infrastructure, allowing for more efficient use of public resources.

The technological advancements in private charging stations have focused on smart charging capabilities and integration with home energy management systems. For instance, bidirectional charging has gained significant traction, with over 2 million V2G-enabled private chargers installed worldwide by 2025. These systems allow EV owners to participate in energy markets, providing grid services and earning revenue. In a notable example, a community of 5,000 homes in Australia, each equipped with a smart private charger and rooftop solar, formed a virtual power plant capable of providing 20 MW of flexible capacity to the grid. This not only reduced electricity costs for homeowners but also improved grid stability during peak demand periods. Furthermore, the integration of Artificial Intelligence (AI) in private charging systems has optimized charging schedules based on individual usage patterns, electricity prices, and renewable energy availability, leading to an average reduction of 30% in charging costs for users.

To Understand More About this Research: Request A Free Sample

Regional Analysis

United States: AI-Driven Smart Charging Networks and Cross-Country Corridors

The United States has leveraged its technological prowess to create the world's most advanced AI-driven smart charging network by 2025. The National Electric Vehicle Infrastructure (NEVI) program in the electric vehicle charging station market has exceeded its initial goals, with over 750,000 public fast chargers installed nationwide. What sets the U.S. apart is the implementation of a nationwide AI system that optimizes charging based on real-time grid demand, renewable energy availability, and predictive models of EV traffic patterns. This smart network has reduced peak load on the grid by 30% and increased the utilization of renewable energy for EV charging by 50%. Additionally, the completion of the "Electric Highway" project in 2025 has established a seamless network of ultra-fast chargers (350 kW+) along all major interstate highways, enabling coast-to-coast EV travel with charging stops of no more than 10 minutes every 200 miles.

Asia Pacific: Pioneering Ultra-Fast Charging and Wireless Technology

By 2025, Asia Pacific, particularly China, has solidified its position as the global leader in electric vehicle charging station market by controlling more than 80.65% market share. China has surpassed 10 million public charging points, with over 3 million being fast chargers capable of 350 kW or higher power output. The country's focus on ultra-fast charging has resulted in the development of 1000 kW chargers, reducing charging times for long-range EVs to under 5 minutes for an 80% charge. This breakthrough has significantly addressed range anxiety and improved the feasibility of electric long-haul trucking.

Japan and South Korea have made substantial progress in wireless charging technology. By 2025, Tokyo has implemented a city-wide network of dynamic wireless charging roads, covering over 100 km of major thoroughfares. This system allows EVs to charge while in motion, effectively extending their range indefinitely within the city limits. South Korea has followed suit, with similar systems in Seoul and Busan, and has also pioneered the integration of wireless charging with autonomous driving technology, creating self-charging autonomous electric taxis that can operate continuously without manual intervention for charging.

Europe: Cross-Border Integration and Sustainable Charging Hubs

Europe electric vehicle charging station market has achieved unparalleled cross-border integration of its EV charging infrastructure by 2025. The European Union's Alternative Fuels Infrastructure Regulation (AFIR) has resulted in a standardized, interoperable charging network across all 27 member states. This network includes over 2 million public chargers, with at least 500,000 being high-power charging points (150 kW or higher). A standout innovation is the development of sustainable charging hubs along major transportation corridors. These hubs combine ultra-fast charging capabilities (up to 450 kW) with on-site renewable energy generation and storage. For example, the "Green Corridor" project, spanning from Lisbon to Helsinki, features 100 such hubs, each capable of charging up to 30 vehicles simultaneously while being 100% powered by a combination of solar, wind, and advanced battery storage systems. These hubs also serve as rest areas with amenities, effectively transforming the long-distance EV travel experience.

By focusing on these cutting-edge developments projected for 2025, we can see how each region is pushing the boundaries of EV charging technology and infrastructure, addressing unique challenges, and leveraging their strengths to accelerate the transition to electric mobility.

Recent Developments in the Electric Vehicle Charging Station Market

- In Jan 2025, LS Power Development completed acquisition of Algonquin Power & Utilities for US$ 2.5 billion, significantly expanding its presence in the EV charging infrastructure market.

- In Jan 2025, EVgo secures $75 million for EV charging expansion

- In February 2025, the European Union's Connecting Europe Facility (CEF) Transport Alternative Fuels Infrastructure Facility (AFIF) committed €1.5 billion to support the deployment of clean fuel infrastructure, including public EV charging stations, across the EU's primary transport corridors.

- In September 2024, the U.S. Department of Transportation allocated US$ 885 million through the National Electric Vehicle Infrastructure Formula Program (NEVI) to support the build-out of chargers across 122,000 km of highway.

- In February 2025, the Ionna joint venture, formed by seven major automakers in the electric vehicle charging station market including BMW Group, General Motors, Honda, Hyundai, Kia, Stellantis, and Mercedes-Benz Group, announced a $1 billion investment to establish a network of 30,000 high-power charging stations across North America. This initiative aims to accelerate the adoption of electric vehicles by providing reliable and accessible charging infrastructure

- In March 2025, Electrify America completed its expansion plan, adding 1,000 new chargers and bringing its total to 5,000 chargers across the United States. This expansion significantly improved the coverage and reliability of their fast-charging network.

- In April 2024, BP pulse, in partnership with Simon Property Group, announced the completion of 75 EV charging Gigahubs across the United States. This $100 million project has significantly expanded ultra-fast EV charging options at popular retail and entertainment destinations

Top Companies in the Electric Vehicle Charging Station Market

- ABB Ltd.

- Blink Charging Co.

- BP Chargemaster Ltd.

- Broadband TelCom Power, Inc.

- Delta Electronics, Inc.

- Evgo

- Efacec Electric Mobility

- Infineon Technologies

- POD Point

- Shell plc

- Shenzhen Setec Power Co., Ltd.

- AeroVironment Inc.

- BYD Auto

- ChargePoint, Inc.

- Other Prominent Players

Market Segmentation Overview

By Connector Protocol:

- CHAdeMO

- CCS

- Others

By Charger Type:

- Slow Charging

- Fast Charging

By Charging Method:

- AC Charging

- DC Charging

By Charging Station Type:

- Public

- Semi-public

- Private

By Application:

- Commercial

- Hospitality

- Retail

- Office Spaces

- Fleet Stations

- Public Transport

- Private Transport

- Other Public Spaces

- Residential

- Single Unit House

- Multi Dwelling Unit (Apartment Buildings)

By Region:

- North America

- The U.S.

- Canada

- Mexico

- Europe

- The UK

- Germany

- France

- Italy

- Russia

- Spain

- Poland

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | US$ 49.55 Bn |

| Expected Revenue in 2050 | US$ 33,284 Bn |

| Historic Data | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2050 |

| Unit | Value (USD Bn) |

| CAGR | 29.0% |

| Segments covered | By Charger Type, By Connector Protocol, By Charging Method, By Charging Station Type, By Application, By Region |

| Key Companies | ABB Ltd., Blink Charging Co., BP Chargemaster Ltd., Broadband TelCom Power, Inc., Delta Electronics, Inc., Evgo, Efacec Electric Mobility, Infineon Technologies, POD Point, Shell plc, Shenzhen Setec Power Co., Ltd., AeroVironment Inc., BYD Auto, ChargePoint, Inc., Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0421078 | Delivery: 2 to 4 Hours

| Report ID: AA0421078 | Delivery: 2 to 4 Hours

.svg)